By Maria MacDougal, College Access Counselor at FAME, one of Maine Jump$tart’s foundational partners and sponsors. Reposted with permission from Munchies, Money, and Mumblings.

Reasons I know I am an adult:

1. I am now a person who scans the receipt before leaving the store to make sure the digital coupons and sales went through.

2. I get very excited when I see how much I saved because of said coupons and deals.

3. Buying meat in bulk and portioning it out & labeling it for the freezer brings me great joy.

When did I become this person? You would think it was when I was in the depths of my financial despair and worried about money, but that is not true. I worried researching deals and “clipping” digital coupons wouldn’t be worth the time. If I had been better at it back then, I might have gotten my financial sh*t together faster! Oh if only! I used to think of couponing like that TLC show that would always have one or two ladies spending Sunday morning clipping tons of coupons and then shopping with reckless abandon. The Crazy Coupon Ladies would then bring us down to their overflowing basements, filled to the brim with a year’s supply of toilet paper, boxes of Saltines, and a host of products they didn’t actually need. It seemed wasteful (and I’d argue that level can be, unless you’re donating the items) and way too time consuming.

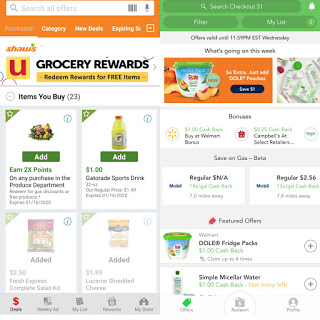

But somewhere between the financial black hole and being able to spend $100 at the grocery store and not cry, I realized I could probably be doing a better job at shopping, and certainly at shopping for food. I started small, trying to maximizing sales and disregarding my foolish brand loyalty to save some money. Now, I diligently use the rewards app for the grocery store I shop at most frequently in combination with a cash back app; both of them offer gas rewards too! I kept these apps in the Great App Purge of 2020 because I use the strategically for grocery shopping, and they don’t entice me to do unnecessary shopping for items I don’t need.

One of the key strategies for this actually starts with menu planning, which has really transformed both our budget and the grocery shopping experience (ugh with these statements who even am I?!). But seriously. Friday evenings, we sit down and figure out what we are going to eat for the week ahead, then we grocery shop accordingly on Saturday morning. We base the meals off of what we also already have in the freezer for proteins, leftovers, etc. or we plan in such a way as to maximize the number of meals we can get out of ground beef, for example. Obviously we have to re-stock the essentials sometimes (bread, milk, pasta) but mostly it keeps us on track and on budget. It also avoids the “what’s for dinner tonight?” question and inevitable back & forth in the moment decision making. If I know there is going to be a sale on chicken or beef, we mold the dinner ideas around those items. Between the coupons and the menu, I am confident we’ve saved probably at least $100/month.

I’m still working on strategy for saving even more. Definitely not to the level of the ladies on TLC, but I’d like to find ways to really maximize saving while shopping. I’ll never forget watching a true master, my friend Alicia, at work. A while back we went to Target, a time warp where budgets go to die, right before her daughter was born. It was to be her last trip before giving birth and was a huge haul. She had it down to a science. We each pushed a cart, filling it with things she needed like diapers, laundry detergent, etc. She had coupons, made use of a couple apps, and was a queen on a mission. At the register, I watch the total creep upward, nearing around $350. And then, the magic started. As the combo deals started calculating, the coupons rolled off, the gift cards were awarded, and whatever grocery voodoo magic happened, I believe the ending total was around $117. I was in AWE. She’s still a Target master, and has taught me some tricks (namely, convincing me to get the Target app for deals) and I will continue to learn from her, especially since I’m boycotting Amazon and will likely need Target more.

“Ooh, I’ve got a coupon for that!” is now a phrase I utter regularly with the same level of excitement I previously attributed to actually exciting things like spotting a puppy. Saving money at the grocery store and watching the total go down is like winning a game and I want to be the best at it.

Do you have any shopping strategies you can share?

The views, information, or opinions expressed in this blog are solely those of the author and do not necessarily represent or reflect those of the Maine Jumpstart Coalition for Personal Financial Literacy.

Maine Jump$tart Coalition

YoutubeFacebook